Caregiving and Guardianship

y husband needed caregiving and guardianship. The first was for care on the inside, in the home we lived. The second was to satisfy legal issues in the world. I am not an attorney. This documents our experience. For more specific information, contact an attorney in your state.

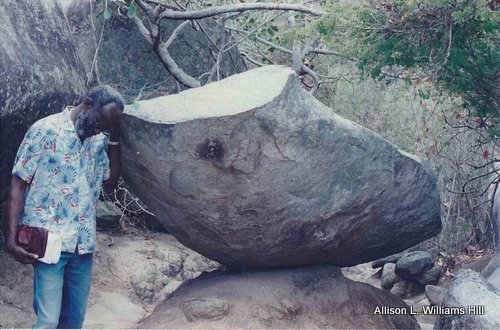

Clem on Virgin Gorda, VI (UK), 1994

People with dementia, Alzheimer’s, or incapacitated by illness or accident, may be unable to make their own decisions. Fortunately, there are legally acceptable ways to represent them. Health proxy and financial proxy are appointed positions issued by the court. I was granted legal responsibility for care and management of my husband’s health and financial wishes.

Clem's Soul Portrait by Allison L. Williams Hill

My husband showed signs of memory lapses almost seven years ago. Within a year, he had an MRI and evaluations from two doctors who diagnosed his dementia. Three years later, after many postponements, we went to the states to visit an anti-aging doctor, Dr. Alan Magaziner, who was kind enough to ignore his general rule of seeing first time patients in the month of October. We made it to New Jersey in February.

The Power of Attorney requires a notary and two witnesses. If the subject appears to be unaware or against the designation, the notary has the right to refuse seal and signature. When we went before a notary to obtain the Power of Attorney, Clem gave the name of another woman who was in his life before me. When we sat before an attorney, he shut down. He was seeing horrifying images that spoke saying I was going to rob and abandon him. I asked him if he had seen any evidence of my doing this. He said no. I asked him if he believed what he was seeing and hearing. He said yes. We sat on the stoop and discussed this. Despite reassurances, he accepted what the images told him.

The third time was in a probate court which was successful, but involved with several steps. Probate court is an alternative to the Power of Attorney. I did not pursue this avenue initially because it required more money, time, and virtually proceeded without my husband’s direct participation.

In South Carolina, guardianship, or legal responsibility for care and management the person or property for an incompetent or minor, and conservatorship, the responsibility of maintaining the property or financial issues of an incompetent, are filed separately. A summons is written and distributed by certified mail return receipt to all parties of interest and the incompetent.

The clock begins when acknowledgement of the summons is received. Interested parties have thirty days to respond.

Within that time, a nurse visited the home in which we stayed and determined if it supports the incompetent’s health and wellbeing. This appointee, by the probate court, is responsible for also evaluating the incompetent and determining if he or she is aware and accepting of the proceedings.

A guardian ad litem is appointed by the probate court to represent the incompetent.

In addition for filing for guardianship and conservatorship, the nurse’s fee and the guardian ad litem‘s fee are paid separately.

LegalZoom.com requests the state in which the document will be filed. After the notary failure, I sought through the Savannah Lower Council of Governments the help of an attorney who could assist in obtaining the Power of Attorney. During the meeting with the attorney, my husband appeared unresponsive. The attorney would not endorse pursuing the matter.

I brought the LegalZoom.com Power of Attorney document to the South Carolinian attorney. She did not feel comfortable using it and insisted on creating one. I questioned other attorneys in the area to notarize the document. The general consensus was that since they did not write it, they wanted nothing to do with it.

Each state is different so research this thoroughly.

Two hibiscus flowers on our property. This represents us then and now.

Photo by Allison L. Williams Hill

Here are some ideas that may be helpful in comprehending the level of efficiency required of a care giver.

Caregiving and Guardianship As Health Care Proxy

1. Involve the care receiver in their life choices. Ask them what they desire. If they are incapable of responding, research among their belongings for answers. If that proves fruitless, make the decision that you think they would make.

I spoke to my husband several times during his illness. His choices changed as his condition did. I suggest the caregiver asks at appropriate times because people change their minds. Write and date all changes.

• Talk with them (if possible) about their preferences: medical treatments, end-of-life care, hospital stays, depending on the level of care required, nursing homes, or hospices, etc.

• Protect signed documents of advance directives such as a living will or DNR (Do Not Resuscitate) orders .

Communicate with Medical Teams

• Introduce yourself as the legal health proxy. Carry a sealed document from the court should proof be requested.

• Ask questions and if you feel a need to get a second opinion, do it.

• Always advocate for what your care receiver would want. Consider thoroughly what others suggest. If it does not fit the senior’s needs, politely decline.

• Attempt to keep notes chronologically for future reference.

• Fear can manifest as anger when discussing your care receiver with medical personnel. Remember to breathe and remain calm.

Monitor Medications and Treatments

• Review medications regularly for safety (especially to avoid dangerous combinations with other medications or foods). Ask if any medications interfere with foods.

• Watch for sudden changes in mood, confusion, or mobility — sometimes medication side effects cause issues.

Care Giving and Guardianship As Financial Proxy

1. Be familiar with the care receiver’s income sources and assets

• Know exactly what the senior's income is:

o Social Security

o Pensions, and

o Any additional sources (investments, annuities, etc.)

2. Arrange for Direct Deposits

• Ensure Social Security and pension payments are directly deposited into a safe, monitored bank account.

• If it is manageable, set aside a small portion of the income.

Present the documents when requested. The bank needs to maintain copies for their records.

3. Create a Monthly Budget

• Track expenses such as rent, or mortgage, gas, electricity, food and supplies, insurance, phone, and medical payments.

• Track essential purchases for the care receiver’s use such as medical supplies, clothing, and bed linen.

If a pension allows a percentage for the caregiver, that was the case with the Veteran’s Administration pension, keep a record of those expenses also.

4. Remain Observant

Protect the care receiver against scams. If he or she is capable of social contact and answering phones, keep an eye on what they do and who they speak to. Make sure they do not give out private information.

• Keep an eye on fraudulent charges.

• Regularly review bank statements, credit reports, and talk to them about avoiding suspicious and unsolicited phone calls, emails, and "unusual" offers.

5. Maintain Records

• Maintain records of all expenses in one place. I created a monthly excel spread sheet and submitted it, each month, to probate court.

• Write reports of all activities my husband experienced. This report accompanied the excel spreadsheet each month. It included:

o Medical appointments and what transpired. This included preparation beforehand. My husband was scheduled for an MRI and he had to fast. I fasted in solidarity with him. I documented when he resumed his meals and what he ate. We did not have a car so a taxi was secured. The cost of round trip transportation was included.

o Physical therapy appointments and what transpired;

o The meal plan. I recorded his meals on a calendar. This list served to prevent repeating foods more than once, maximum twice in four days so he would not experience food allergies.

o The vitamins and supplements taken daily.

o His moods – how I perceived he was feeling. I recorded how he slept, if he appeared to be in pain, and when he was in pain.

• Keep all receipts to be listed in the spreadsheet, chronologically arranged and put in labelled envelopes. They can be scanned into a computer and printed or emailed. If they are subject to review, it will make it easier for the reviewer and other people involved (family members).

• Keep detailed records of all financial decisions you make on their behalf. Accurately and truthfully documenting this responsibility protects you legally and demonstrates that you are acting in the care receiver's best interest.

6. Know Government Rules and Comply

• Read Social Security notices and other income source information when they are available to know how it impacts health insurance benefits. Keep them in the binder should they be needed for reference.

• Be knowledgeable about changes in health care or hospital care for the cared-for. Hospital departments, the ICU, and CCU for example, may have different requirements, coverage, and levels of medical services. Hospitals and nursing homes have different programs and services. It is directly connected to the care receiver's insurance.

• Pensions have specific requirements that may change periodically. It is the caregiver’s responsibility to be aware of any changes that will affect the care receiver.

Caregiving and Guardianship General Caregiving

• Be patient and compassionate. Independence, for most care receivers will reduce or disappear entirely. Their world is changing and they may have less control than they are used to. Help him or her readjust in a kind and gentle way.

• The care giver needs care. Maintain your center. Periodically check for tension in the body. Find the rhythm with the care receiver so time for the care giver can be integrated with the care receiver’s needs.

• Stay Transparent — If possible, involve family in major decisions for transparency and peace of mind.

Caregiving and Guardianship Summary

Important Documents to Always Keep Handy

- Health Care Proxy paperwork

- Power of Attorney (POA)

- Living Will and other Advance Directives

- Social Security award letters

- Pension statements

- Insurance policies

- Bank and investment account information

- Health insurance cards and policy details

Caregiving and Guardianship Checklist for Care Receivers

(Health Care Proxy & Financial Proxy)

Health Care Responsibilities

- Review and keep a copy of their advance directives (Living Will, DNR orders).

- Maintain a medical folder: doctors' contacts, medication list, allergies, insurance info.

- Attend medical appointments (in-person or virtual) and advocate for their wishes.

- Monitor medications for side effects or changes needed.

- Communicate regularly with doctors, specialists, supporters, and family.

- Schedule and track all medical checkups, dental, and vision appointments.

- Keep a list of their preferred hospitals and specialists.

- Understand their health insurance coverage (Medicare, supplemental plans, Medicaid if applicable).

Financial Responsibilities

- Ensure Social Security and pension payments are set up for direct deposit.

- Create and maintain a monthly budget (housing, food, utilities, insurance, personal care).

- Review bank statements monthly for errors or suspicious activity.

- Set up alerts for suspicious transactions if possible (fraud protection).

- Maintain organized financial records (income, bills, tax papers).

- File taxes on their behalf, if needed.

- Stay informed about Social Security and pension program rules.

- Keep receipts and logs for any major purchases or bill payments made on their behalf.

General Guardianship Care

- Communicate openly and kindly with the care receiver about decisions when possible.

- Keep other close family members updated when appropriate.

- Keep other close family members updated when appropriate.

- Take time to care for yourself includes personal hygiene. I see others, am one, and have constant conversations with another caregiver.

o Take mental breaks. Meditation is excellent, even if it is for five minutes at a time.

o If necessary, join a support group in person or online. There may be shared insights that relate, or ideas to address timely issues, how to dress the care receiver, how to help them gain mobility, etc. among other members.

o Attempt to organize rest days. This may be a challenge due to the responsibilities required for the care receiver. - Review and update important documents once a year or after major life changes.

Links

The above meditation mandala will be available soon.